To envision and grow as digital insurer

of the future, Insurers need reliable

trusted vendor Partner(s) in their

transformation journey.

KInS enables Insurers to accelerate their digital transformation journey

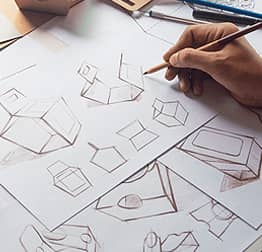

Looking for a reliable

partner that will give form to

your ideas?

Leverage our expertise to formulate your ideas

Kumaran’s MVP-as-a-Service is offered to help Business and IT leaders to formulate ideas into MVP’s leveraging new age technologies for launching new products/services or for increasing Operational efficiencies that generates value for business. With deep industry and technology expertise, we can design, build and deliver MVP that is workable, market ready and goes beyond prototyping for you to demonstrate your use case for Executives buy-in.

Kumaran helps insurance companies to formulate

ideas through

Research

addition

Features

Stack Fit

Talk to Us

Please drop in your details and we will get in touch with you shortly.

Learn more about our specialized 4Sprint MVP strategy.

Our exclusive 4Sprint MVP strategy considers key aspects of agility, time and budgets that will

fit your MVP requirements – Talk to us to learn more.

Cognitive Document

Processing

Capitalizing on the cognitive capabilities of

AI and ML to enhance the document processing

Insurance is a document intensive industry – Optimize

operational efficiency with Kumaran’s Cognitive Document

Processing Services that harnesses the power of AI and ML

to automate complex document processing of structured and

unstructured data using robust cloud native tools combined

with Kumaran capabilities

Extract Claims Loss

history from Loss

Run Reports

Overcome challenge in

extracting loss data from

extremely complex

non- normalized loss run

format across carriers and

convert into common format

Extract Key

Values for

Auto Indexing

Automate key pair

data extraction from

unstructured large

complex documents

for Auto Indexing

Insurance Customer Centric Solutions

Enhanced customer experience is a core value of Kumaran and we are committed to provide exceptional CX beyond on boarding to

the digitally well connected new consumers. Kumaran enables abundant touch points for improved customer

engagementand retention through Insurance Customer Centric solutions (Incentricity)

Digital FNOL

Enhance customer experience

at Moment of Truth –

Pre-filled Policy details

with rich media support

for Policy Holders to

report claim

Unified View

Solution for Insurance

Broker’s Customers –

View and Manage multiple

Insurance Policies

across multiple carriers

and business lines

Notify

Automated event based

notifications to

customers – Claim Status

Updates, Personalized

wishes and Alerts in the

event of an

emergency(Weather, State Advisory etc.)

Any time Service

An omni-channel

self-service solution

for Insurers to offer

business customers to

manage all customer

touchpoints in seamless

and connected journey

Insurance IT Solutions & Services

Discover a wide range of focus areas in our IT solutions that we are offering over the years

to assist insurers in building their own technology platform with required capabilities.

Modernization

We help enterprises to

stay relevant and

upgraded to latest new

technologies

- Mainframe Migration

- Legacy Applications

- Legacy Datasources

- Legacy Reports

Enterprise Data

We are assisting and

guiding our clients through

variety of data related

offerings to serve their

business

- Data Conversion

- Data Migration

- DWH – ETL Maintenance

- Data Analytics & BI

Cloud Enablement

Our cloud offerings enable

organizations to reduce

overall IT costs and reap

maximum benefits

- Cloud Migration and Deployment

- Cloud Development and Deployment

- Cloud Infrastructure Services

- Cloud Support Services

Enterprise Applications

We help clients reap the

benefits of the latest

technologies while

continuously modernizing

the ecosystem.

- Application Development and Managed Services

- QA Services (Automation & Manual)

- Custom API Development

- Resource Augmentation

Our kins in the Insurance Space

Kumaran has made commendable contributions to the insurance industry through our offerings over the years.

Through our continuous innovation and incorporation of emerging technologies Kumaran’s network of kins empowers businesses

from these business segments to be agile, scalable and swift in their business operations

P&C and Life Insurers

We provide IT services to assist and help Insurer’s across P&C personal and commercial, Life and Reinsurance verticals, in building and maintaining their own technology platforms or development of custom solutions

Techno Functional Teams

Innovation Lab

Flexible Engagement

Insurance Broker and Agencies

We help you in implementing technology that empowers you in dealing with new age digital customers and deliver superior customer service. Our experts can team up with you to determine strategy and implement technology to support customer acquisition, customer engagement and integrating with Insurers systems based on your needs and budgets.

IT Advisory

Tailored Solutions

Pricing Model that suits

InsureTechs

Leverage our knowledge and experience in the insurance industry that helps you to build a fit-for-purpose team around your solution.

Deep Domain Expertise

Technological competence

Agile Delivery

Expanding the

Partner channel

Creating a lasting and a productive

impact to our KInSKumaran aims to foster a robust partner network to pool the resources and share the collective vision to make invaluable contributions as a unit to the insurance ecosystem.

Kumaran strives the leverage the collective capabilities of us and our kins in the insurance space to exponentially innovate and offer the best fusion of solutions to the insurance industry

Insurance

Product

Companies

IT Solutions

and Services

Companies

Technology

Companies

The Kumaran Advantage

Joining hands with Kumaran on your digital transformation journey is the business equivalent of transferring

our expertise and boundless capabilities into your workflow