Efficient computation of internal

risk rating based on varied

risk parameters

Internal Risk Rating based on quantitative and qualitative factors

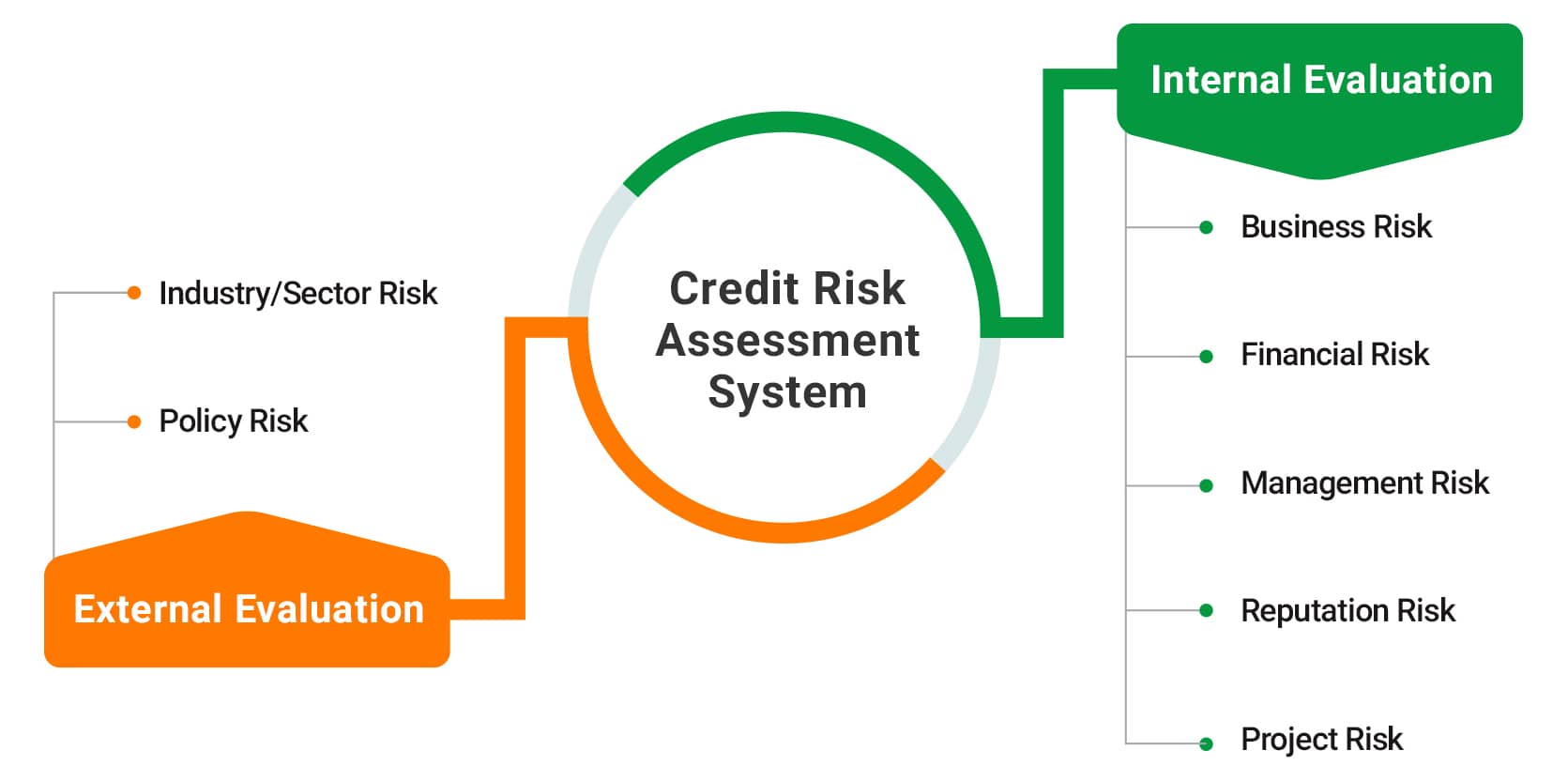

Kumaran Credit Risk Assessment system provides instantaneous “internal risk rating” for any borrower based on quantitative as well as expert-judgmental factors coupled with higher and lower bounds of scores. This rating can be customized by the bank based on its internal policy.

This credit risk assessment system can be used for risk rating of customers belonging to corporate, commercial, small business, Health care, Education and agricultural business entities.

Some of the

features of Credit Risk

Assessment System

are as follows

– Industry/Sector

Risk & Policy Risk

– Business Risk

& Financial Risk

estimates and

Financial Projections

comparisons ad trends

to analyze specific

portfolios

collection of

historical

financial data

Benefits Of

Credit Risk

Assessment System

Banks can leverage the capabilities of Kumaran’s Credit Risk Assessment System to harness the benefits

- Streamlines tasks / reduce redundancy of work

- Can be easily integrated with other business application software

- Accessible from anywhere & anytime

- Easy online payment facility

- Get updates & amendments separately

- Enable the clients to increase operational efficiency & reduce cost

- Comply with prevailing banking regulations

Credit Risk Assessment System