Articulated collection of credit

details to enable enhanced credit

decision making

Enabling improved risk assessments through collected data

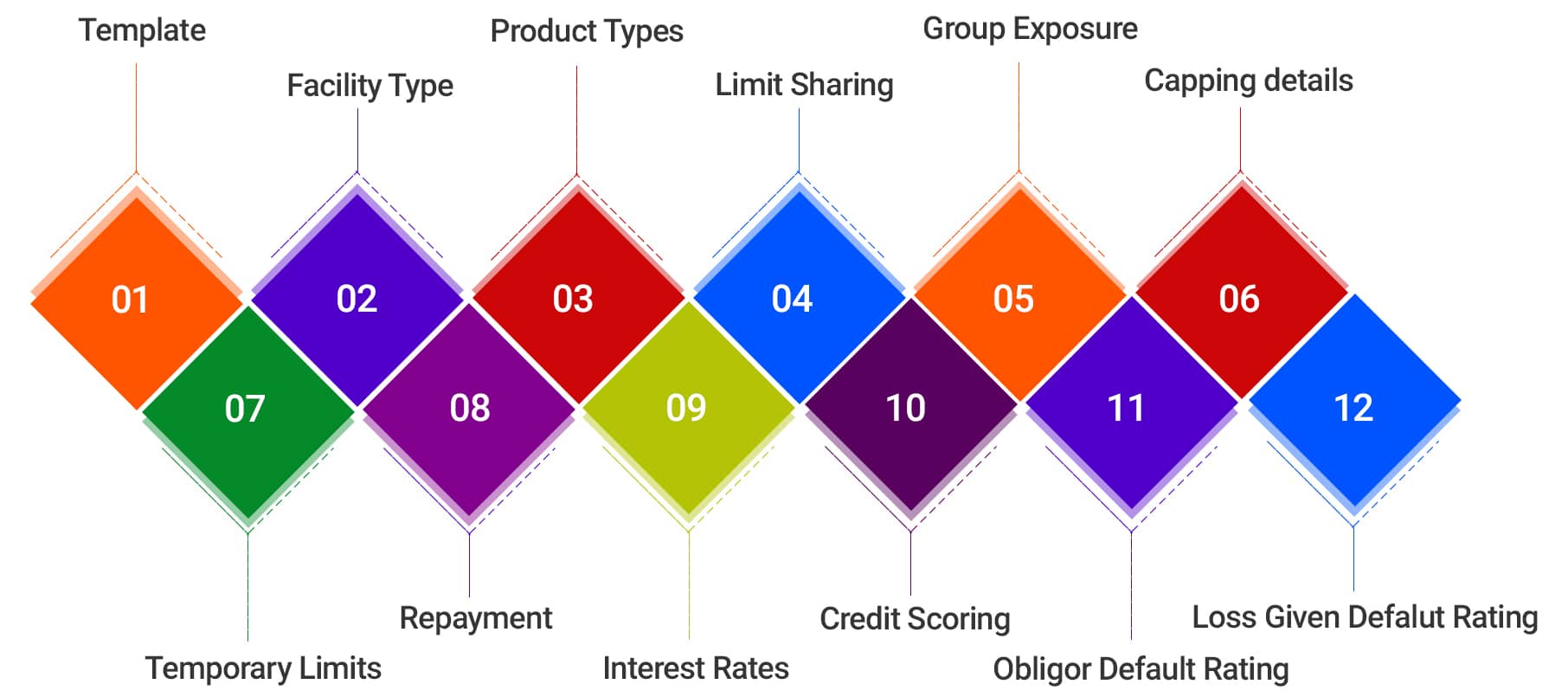

Kumaran’s Credit Structurer supports the underwriting process; defining the full details of the credit and completing the appropriate risk assessments like credit Scoring, Obligor Default Rating, Loss Given Default etc.

Kumaran’s Credit Structurer aids to calculate the credit needs of customers confidently and to limit the client’s exposure in line with the latter’s credit risk profile

Features of Credit Structurer

Benefits Of

Credit Structurer

- Consolidated details about the credit captured

- Improve the standards in credit decision making

- Flexible to use

- Aids in calculating the most suitable equity

- Calculate the tenor of each financing and allows to record the repayment details

- Allows to choose the interest rate whether it is fixed or floating along with the interest rate details

- Capturing of Risk assessment details like credit scoring, Obligor default rating and Loss Given default rating

Credit Structurer