Proactive asset characteristics

monitoring and alerts to identify

irregularities

Asset characteristic monitoring in early stages

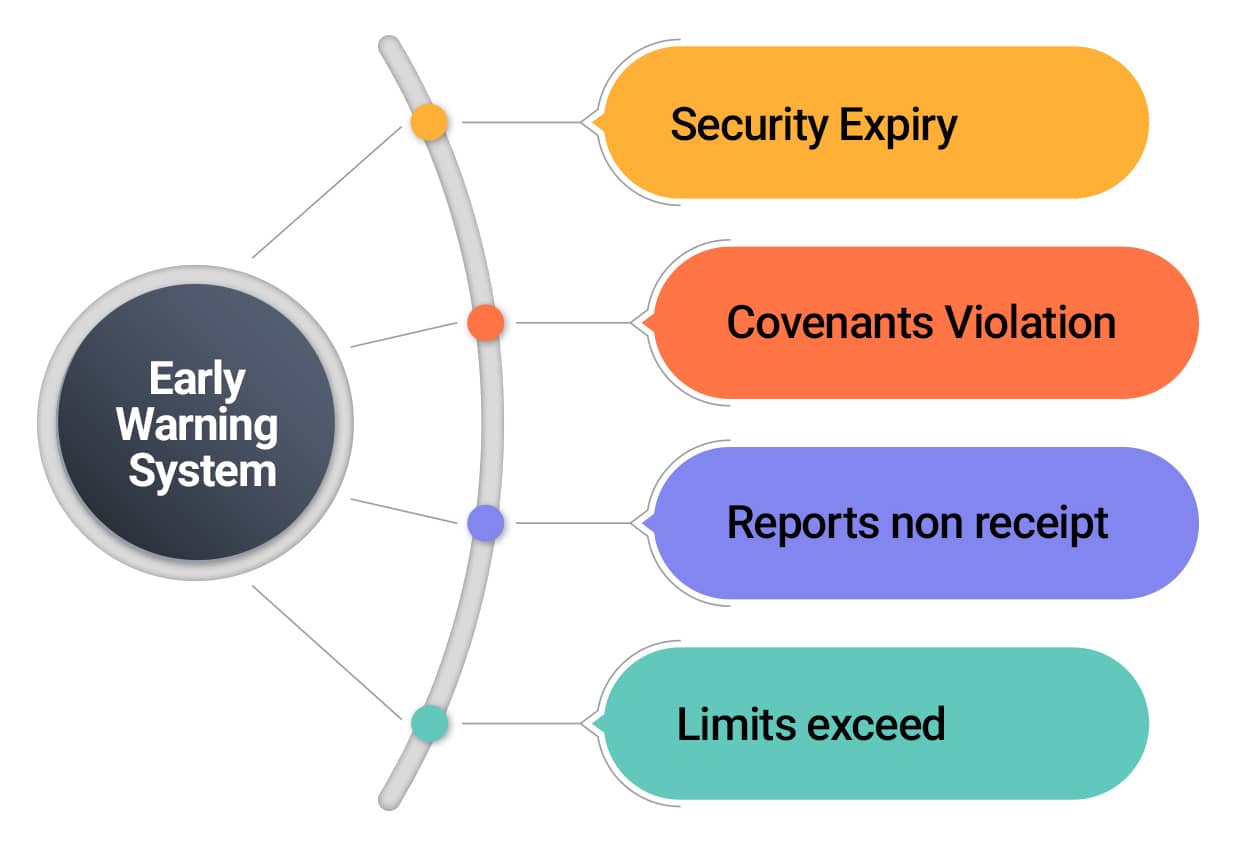

Kumaran’s Early Warning System enables centralizing the processes of margins, covenants, securities, instruments and irregularities.

Our EWS system alerts the credit officer users and credit specialist users of the broken EWS signals with an email trigger. This system identifies the EWS pattern and notifies about any deteriorations in trends.

Apart from notifying deteriorations, EWS’s proprietary ‘Irregularities Scorecard’ constantly monitors the borrower level and portfolio level irregularities.

Features of Early Warning System

Benefits Of Early Warning System

Performing assets changing into Non Performing assets is a threat to most of the Financial Institutions.

- Aids in effective implementation of a Credit Monitoring System (EWS unit)

- Enables financial institutions to correct irregular events in initial stages

- Hinting anomalies in credit history by frequent credit checks and inquiries

- Indicators such as geographic indicators, industry indicators and perception indicators

Early Warning System