Off-loading your impaired loans the

smartest way by eliminating

conventional models

Plug-in the latest capabilities for valuation, analysis and asset organization

Off load your impaired loans with the infusion of technology

Kumaran’s Impaired Loans Manager is a technology solution that enables accurate valuation, analysis and asset organization eliminating the need for using massive spreadsheets and the various complications that come along with it.

With ILM service, Kumaran Systems assists client banks by providing a professional solution that delivers a precise valuation of impaired loans portfolios, the ability to identify the optimal management strategy for these assets, virtually unlimited capacity and precise estimation of loan loss for the Bank.

Features of Impaired Loans Manager

ILM lays out all of a loan’s possible cash flows until the optimal type of resolution is identified and can then be executed. This is achieved by calculating a discounted cash flow on all expected net cash flow from the loan through workout to performing status, or from underlying collateral if the loan is liquidated.

Lists all possible cash flows and suggests an optimal resolution method and execution

Approved

If the application is complete and all aspects of the application are in compliance with bank policy and assessment of good risk, the Risk Manager can accept the application as presented.

Approved

If approving with changes, the Risk Manager makes the necessary adjustments and documents the reasons for that action.

Declined

If the credit application is unacceptable or is not a good risk, it can be declined. As with an acceptance, the Risk Manager must supply reasons for his or her decision.

Deferred

If the credit application is unacceptable or is not a good risk, it can be declined. As with an acceptance, the Risk Manager must supply reasons for his or her decision.

Cancelled

This archives the credit. It will be listed under Cancelled credits on the My Account > Cancelled Credits sub-link on the dashboard.

Referred to SMA/NPA

This decision is made when the sanctioning authority feels that the credit will be a non-performer. These types of credits are maintained separately by Account Manager SMA/NPA.

Calculation of discounted cash flow on all expected net cash flow

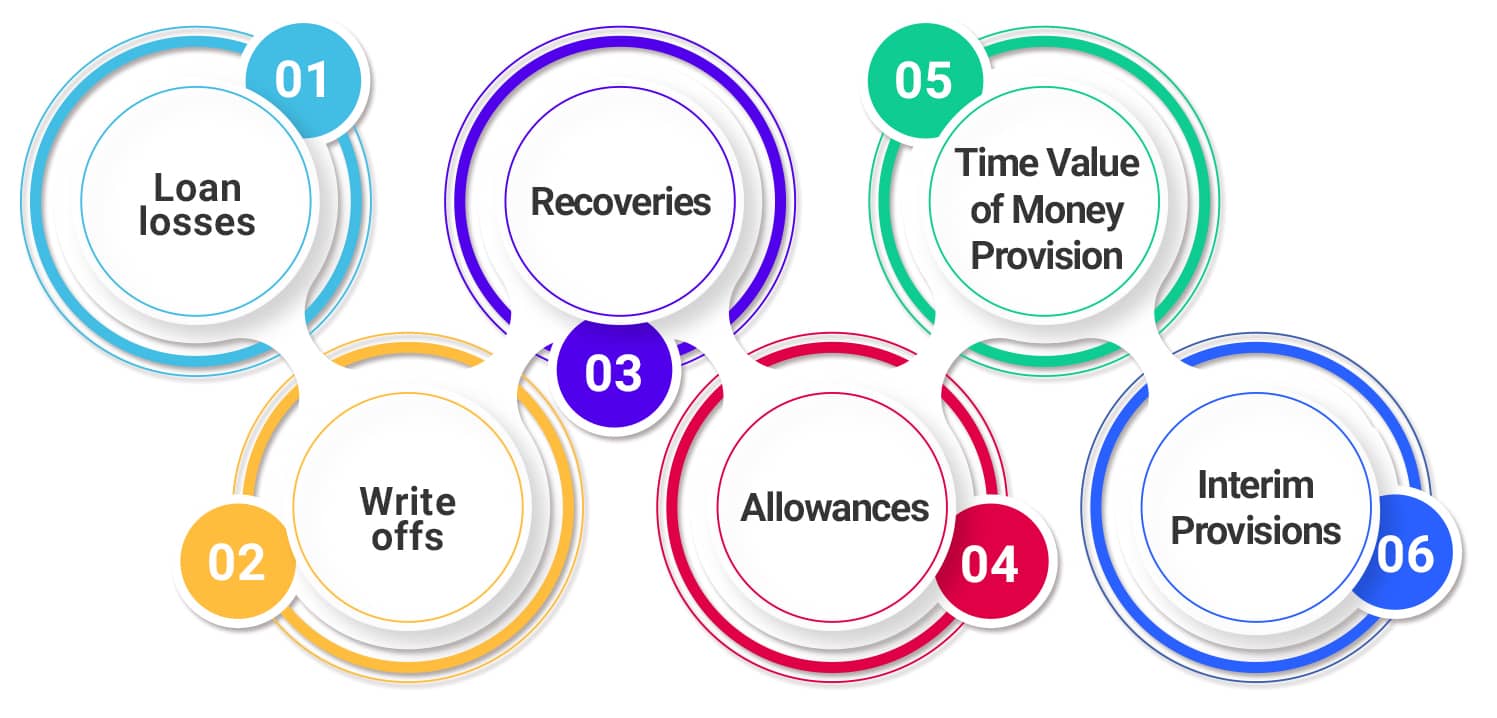

Capture loan loss information

Loan loss report generation for business insights

The system supports accounts in different currencies and multiple languages too.

It supports mobile banking and internet banking

Benefits Of Impaired Loans Manager

Highly scalable and a modular solution that comes with a whole range of functionalities for impaired loans management

- Houses information of loan loss, cash flow, outstanding balance, demographics, monitoring period, customer default/instance of default, type of resolution.

- Report generation for management and regulatory purposes.

- Highly-scalable and modular implementation

- Application clusters for maximum availability

- Loosely coupled, highly flexible and easily integrated with any internal or external systems

- Technology and interface in line with today’s industry standards