Enhancing the Credit Risk Analysis by

meaningful representation of credit

portfolio & performance data

A virtual system to amass all credit data at one place

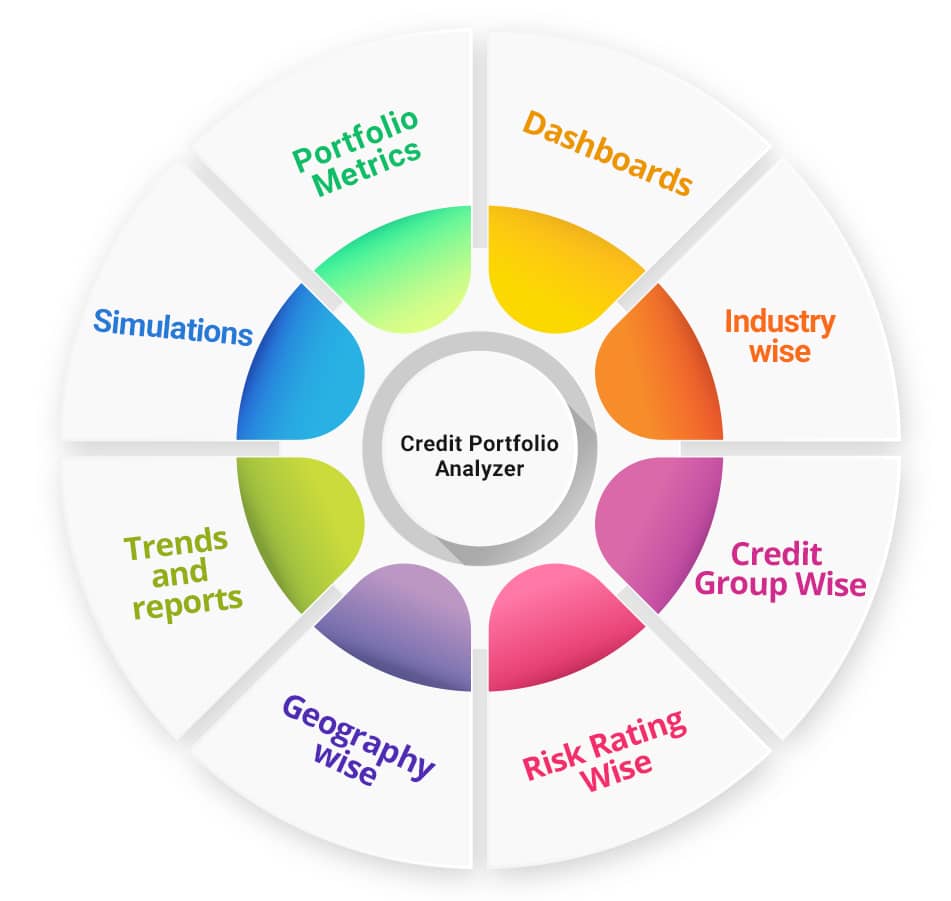

Credit Portfolio Analyzer System is a virtual agent for credit risk professionals providing the metrics they need for credit risk analysis. Credit Portfolio Analyzer system is a repository that contains portfolio and performance data gathered from different applications.

Credit Portfolio Analyzer System presents the portfolio data as dashboards, charts and reports and the visual representation enables user to quickly understand the data represented.

Features of Credit Portfolio Analyzer

Credit Portfolio Analyzer enables self-service analysis of credit portfolio & operational performance data.

Credit Portfolio Analyzer provides a comprehensive usable data model & analytic tools.

CBy leveraging all available data, Credit Portfolio Analyzer highlights changes in real time so that credit professionals can respond more quickly.

Credit Portfolio Analyzer is a powerful tools that enable a thorough and consistent analysis of the entire credit portfolio, with the ability to view and report on data from portfolio level down to individual accounts.

Credit Portfolio Analyzer provides flexible data segmentation so that users can drill down into the portfolio to continuously monitor concentration levels by exposure, industry segment and geography

Approved

If the application is complete and all aspects of the application are in compliance with bank policy and assessment of good risk, the Risk Manager can accept the application as presented.

Approved

If approving with changes, the Risk Manager makes the necessary adjustments and documents the reasons for that action.

Declined

If the credit application is unacceptable or is not a good risk, it can be declined. As with an acceptance, the Risk Manager must supply reasons for his or her decision.

Deferred

If the credit application is unacceptable or is not a good risk, it can be declined. As with an acceptance, the Risk Manager must supply reasons for his or her decision.

Cancelled

This archives the credit. It will be listed under Cancelled credits on the My Account > Cancelled Credits sub-link on the dashboard.

Referred to SMA/NPA

This decision is made when the sanctioning authority feels that the credit will be a non-performer. These types of credits are maintained separately by Account Manager SMA/NPA.

The system supports accounts in different currencies and multiple languages too.

It supports mobile banking and internet banking

Benefits Of Credit Portfolio Analyzer

The entire set and sub set of credit portfolio data collated on a single dashboard

- Perform credit portfolio management and risk analysis effectively

- Simulates and visualizes the sensitivity analysis by changing collateral value or interest rate

- Helps to identify and track risks due to concentrations of credit

- Helps to record relationship profitability and to track industry sector exposures and trends

- Analyze credit risk at portfolio or customer level effectively

- Generates detailed and summary business intelligence reports in minutes, providing real-time data, graphs and comments in a clear manner.

- Standard and custom reports can be generated