Smarter pricing engine that sets loan

prices on assessing various

credit parameters

Intelligent pricing engine for all lines of business

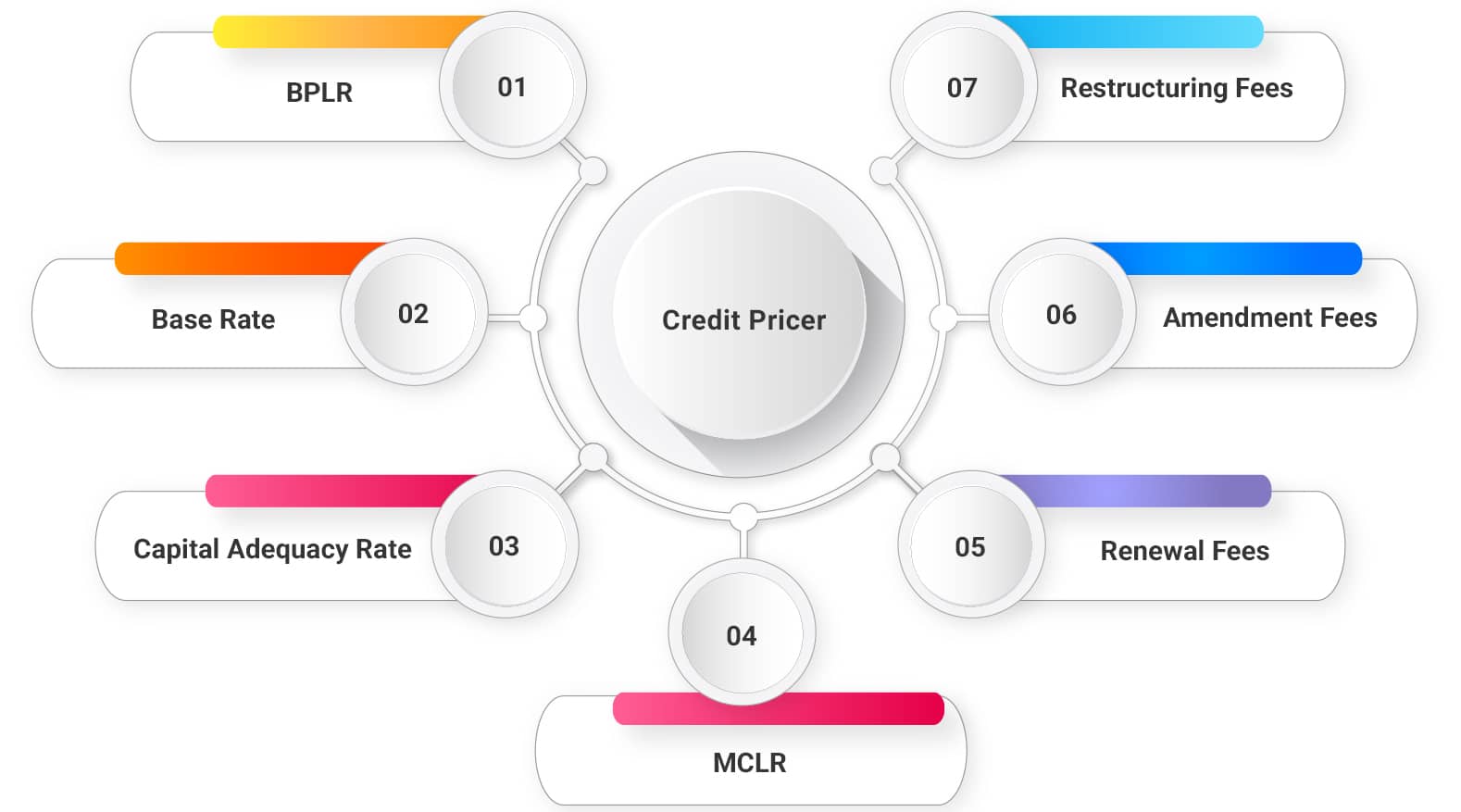

Credit Pricer is a centralized and relationship based pricing engine. The pricing engine can be used by all lines of business and the interest rates & fee structure can be customized to each line of business.

There are different pricing models to set the price for loans based on profitability targets and loan portfolio combination, loan type, payment structure, borrower’s relationship with the bank such as credit history and deposits held.

Features of Credit Pricer

Benefits Of

Credit Pricer

Accurate pricing model accounting all the parameters of interest rate, risk rate, costs and fees

- Increasing client loyalty and decreased revenue leakage

- Effective loan pricing can optimize capital.

- Transparent Pricing

- Cross-selling is easy

- Dynamic pricing is possible

- Enhanced Customer experience

Credit Pricer